In response to the fast changing business environment, SEBC regularly organizes trainings, seminars and workshops of a wide range of themes to equip social enterprises with market savvy business knowledge. Moreover, SEBC endeavors to make the most out of these capacity building programmes by preserving and disseminating the invaluable knowledge and insights shared by speakers. This webpage recapitulates content highlights of selected events.

- Learning from Games (based on networking and sharing session of the Social Innovation Series took place on 21 June 2019)

- Basic Marketing Skills (based on a seminar took place on 10 May 2019)

- Symbiosis between Arts and Inclusion (based on a networking and sharing session of the Social Innovation Series took place on 15 March 2019)

- Considerations to Legal Forms and Corporate Governance of Social Enterprises (based on a seminar took place on 22 February 2019)

- Corporate Governance and Financial Competitiveness of Social Enterprises (based on a seminar took place on 22 January 2019)

Learning from Games

Author: Janie Chan, Social Enterprise Business Centre

According to the latest figures from the Legislative Council, the number of students with special educational needs (SEN) in mainstream schools has been on the rise. Compared with the 2013-2014 academic year, the number of SEN students had increased by 34.1% and reached 45,360 in 2017-2018. Apart from enhancing the support for SEN students, many social welfare organizations and social enterprises endeavor to serve SEN students in different ways, to help them overcome learning barriers and realise their full potential.

In the latest social innovation series that focused on children with special education needs, Ernest and Jason, respectively founders of “AR Training Play” and “SEN Students and Parents Self-Help Technique Development Scheme”, both grantee projects of the SIE Fund, were invited to share their experience in developing innovative projects to empower SEN children to overcome learning difficulties through games.

Game is the language of children

As children have limited language skills, they often find it uneasy to articulate their thoughts in clear or complete sentences. Through games, nonetheless, children tend to be able to more naturally express themselves. Ernest of “AR Training Play” is convinced that “game is the language of children”. He and his partner Zero jointly developed interactive game books that make use of varied technologies including Augmented Reality (AR), Motion Sensing Games, 3D Model, Virtual Reality (VR), and Leap Motion. These games can help enhance SEN children’s literacy skills and comprehension, and in turn help them acquire the Chinese language more effectively.

As a new and innovative tool, “AR Training Play” aims at complementing (and not displacing) traditional support services for SEN students. Its built-in data collection function enables an efficient collection and recording of the players’ learning progress, based on which support service providers can make constructive adjustments to their intervention in a timely manner. One of the event attendees who comes from an SEN children support social service background agreed that “AR Training Play” can instigate an effectiveness enhancement of traditional support services; but he pointed out that, at present, the government did not seem to have a policy framework to allow schools or service units to purchase such innovative technology products. In addition, there are too few channels for service operators to obtain information about innovative technological service products.

From “self-help” to “helping others”

Jason of “SEN Students & Parents Self-Help Technique Development Scheme” has been diagnosed with Attention Deficit Hyperactivity Disorder (ADHD) and Asperger syndrome since childhood. He was accustomed to being punished by teachers when he was a kid. Since ADHD patients are more impulsive and less concentrative, Jason has encountered social obstacles, both at school and at work, which have hindered his development in interpersonal relationship and career.

In order to understand more about various neurodevelopmental diseases, Jason studied a diploma course in psychology. Through his studies, he has identified three ways to help SEN children in self-development: Language, Reasoning and Attitude. Upon graduation, Jason started a company called “Minds On”, which used LEGO as the main teaching tool. Based on his findings, he designed courses that help children discover ways to improve their intelligent memory, organisational skills and expression, communication skills, and thinking modes using multiple perspectives, so as to regain confidence in social occasions.

In the group discussion session, a school-based social worker mentioned that she often had to support SEN children too. She too often deploys various game activities to help them better integrate in schools - but the real difficulty lies on encouraging children apply what they have learned from the games in their daily lives, such as communication skills and behavior control. Echoing to this, Jason responded that the key point is to guide the students to objectively analyze problems and evaluate solutions, so that they can make good use of these skills in daily lives. Also, he believes the cooperation between family and school is extremely important. Therefore, his project also organizes parent support activities such as “parent-child workshops”. Each child attending the workshop will be given a personal report with guidelines, which makes a useful reference for parents and teachers to review their parenting or teaching methods to support the SEN children.

Over 20 SEN support service providers and representatives of social enterprises have attended the seminar.

Speaker Ernest (second from left) and Jason (middle) photographed after the session.

Thanks to Ernest and Jason for their heartfelt sharing in the session.

If you would like to know more about “AR Training Play for Children” and “SEN Students & Parents Self-Help Technique Development Scheme”, please visit the following websites:

AR Training Play for Children: http://www.aesir.hk

SEN Students & Parents Self-Help Technique Development Scheme: http://www.minds-on.com.hk/

Basic Marketing Skills

Author: Janie Chan, Social Enterprise Business Centre

Marketing is an important part of business success. A successful marketing strategy can effectively promote products or services to the public; it may even increase sales and turn losses into profits! However, most social enterprise practitioners are not from a professional marketing background, so they may lack experience, knowledge and skills to conduct a long-term planning for brand promotion. In order to enhance these social enterprises’ marketing knowledge, the Social Enterprise Business Centre held the “Social Enterprise Seminar: Basic Marketing Training” on May 10. In the seminar, Mr. Johnson Lo, seasoned branding and marketing expert, and Founder of Sprouts Concepts as well as Chairman of Chartered Institute of Marketing (CIM) Hong Kong Branch, shared basic marketing knowledge and talked about what elements should be included in a presentation deck (PowerPoint) for brand or products promotion.

Know thy enemy, know thyself: Detailed market research leads to smart market positioning

Market research is the first step to marketing, which enables a better understanding of the strengths and weaknesses of your company’s potential competitors, the latter of which may lend insights into how your company should be positioned (i.e. which gap to fill) in the market. Further, it is as important for one to know your own company: “If you don’t know your own brand, it means you are not ready to promote your products or services,” said Johnson. Beyond its products or services’ strengths and weaknesses, a business should also thoroughly identify, understand and analyse the difficulties and needs they have, and support and resources available, which will inspire better marketing. Johnson also reminded participants that in marketing, not only should the benefits of the products or services be lauded, but weaknesses should also be addressed so they become accepted by the market, which will help the business stand out from its opponents.

Marketers need to position their brands and target particular market segment(s). With regard to branding, two approaches of consideration are “cost” and “benchmark”. "Cost" refers to the cost of the brand, such as raw materials, human resource, time, and even branding expenses; and "benchmark" refers to the (level of) standards of competitors, brand value, and company size. Most importantly, market positioning should be informed by market research – and yet most people only take into account “cost” and often slip conducting and considering market benchmarks. A detailed investigation of competitors in the market is fundamental to market positioning of your own company, and establishing a unique image for the brand.

Include brand building cost in marketing budget

The majority of social enterprise practitioners find writing marketing budget a challenge. In order to create a budget reflective of actual needs, Johnson suggests that practitioners first identify their objectives and consider the target return on investment (ROI). This means that they should focus on not only the annual sum (of marketing) but also the percentage change on a month-to-month basis. Apart from short-term factors like promotional campaigns and sales growth, long-term strategic efforts for brand building should also guide the preparation of a sound budget. Brand building is a critical part of marketing but is often missed budgeted for.

Create a win-win situation with Creative Partnership

Nowadays, partnerships and joint promotions are popular business tactics, between businesses of the same or even different natures. Acknowledging that they have the potential to yield effective marketing results, Johnson reminded participants that the choice of partners and collaborators is pivotal to the success (or failure) of the promotional effort. He introduced a mental exercise known as “Fruity Thoughts”, which helped finding suitable promotional partners. For instance, slicing and shredding are two different ways to cut a lemon - just as how one may look at the same thing from different perspectives. Furthermore, lemons can have many possible combinations with other food or drinks such as coke with lemon, and honey lemon water; with a bit of imagination, two different items can amalgamated into a new object. Johnson proposed six key points in choosing promotional partners:

- (Shared) Social Mission

- Functional Matching

- (Different) Target Market Segments

- Complementarities

- Cost Efficiency

- Timing

Joint promotion accentuates differences between products, conducive to effective branding through establishing a significant and differentiated presence in the market, which hopefully subsequently helps attracts and retains loyal customers.

Presentation deck for brand promotion

A presentation deck (such as in the format of PowerPoint) is often used in pitching, sales or brand promotion. Since presentation time is limited, the content, design and layout of the deck can have a huge impact on the audience's first impression of the company, and in turn its decision-making with regard to the purchase of the product or service.

To craft a presentation deck that appeals to potential customers, Johnson made several recommendations:

- The outline must be conceived in advance to ensure clear conveyance of information

- The contents should not be cumbersome; avoid adding too many images and special effects

- For data presentation, consider using charts for neatness and easy comprehension

- For citations, always spell out sources of factual evidence to enhance credibility

- Pay attention to the aesthetics and professionalism of the deck e.g. only use company logo(s) with a transparent background

In addition to the design and layout of the presentation deck, time management of the speaker is equally important. Long speeches do not allow audience to deepen their understanding of the brand, it would only reduce their interest to collaborate or purchase, which is counterproductive.

Johnson (speaker) spoke on the basics of marketing. Staff of SEBC presented souvenirs as a token of thanks to Johnson (left).

Symbiosis between Arts and Inclusion

Author: Joyce Wong, Social Enterprise Business Centre

At present, there are a lot of social enterprises and social service operators that provide platforms for people with different abilities to realize their worth - in domains of education, sports and arts, as well as promote social inclusion. To facilitate exchange between different stakeholders in the inclusion and arts sectors, the Social Enterprise Business Centre runs a “Social Innovation Series”, comprises quarterly meet-ups at which participants converse with each other, so as to exchange and expand their knowledge, skills and network.

The last such event was held on 15 March, themed “Arts and Inclusion: Projects related to People with Different Abilities”, at which two social innovators were invited to speak on their experience in developing projects that champion equality in arts sharing and performance. The two speakers were: Rico, Founder of “Beyond Vision Projects” (BVP), a grantee project of the SIE Fund; and Comma, Founder of “Theatre in the Dark” (TiD). They also had a heart-to-heart with nearly 20 participants on how to create art through inclusion; and ways to achieve inclusion through arts.

Learning from people with different abilities

BVP is a project about Tactile-Audio Interaction System (TAIS). Rico believes that everyone has the rights to enjoying arts and visual cultures; and that vision and even cognition are not the only means to achieve this. Even though Rico has full vision, he received a lot of help from visually impaired people when he was on his PhD research. In order to express his gratitude, Rico set-up BVP, a social enterprise that helps presents the visual world through touch and sound to the blind. The TAIS cultivates users’ curiosities and encourages asking questions. Rico believes that asking questions is the first step to inclusion.

Apart from using arts to facilitate inclusion, Rico has also hired a staff who is physically challenged. “Facing challenges is a stage everyone must go through in growing and learning, including people with different abilities. We should not underestimate their capabilities - because we always learn from one another, instead of one party just giving help to the other uni-directionally,” said Rico.

Equal pay for people with disabilities, commensurate with their equal worth

TiD is founded by Comma, who has non-congenital blindness. It is an equal arts platform that allows people with different abilities shine - while making a decent remuneration with dignity. Performers include people with visual impairments, people who are formerly mentally ill, people with autism, people with intellectual disability, and the non-disabled. Speaking of “discrimination”, Comma mentioned that even though it creates hard feelings, “discrimination” is still better than “disregard”.

Further, Comma advocates equal pay for people with disabilities. Some participants agreed, but lamented that too few employers were willing to give equal pay to people with disabilities. “Equal pay for people with disabilities is absolutely important. We need to let them know that their disabilities neither make them cheap labor, nor them necessary beneficiaries of our charity or pity; rather, they demonstrate their talent and capability that deserve equal and respectful pay,” Comma responded.

Rico (left) and Comma, respectively founders of Beyond Vision Projects and Theatre in the Dark.

Thanks to Rico and Comma for speaking at the seminar and spurring a very fruitful discussion.

More about Beyond Vision Projects and Theatre in the Dark:

Beyond Vision Projects - http://www.beyondvision.asia/

Theatre in the Dark - https://www.tidhk.com/

Considerations to Legal Forms and Corporate Governance of Social Enterprises

Author: Janie Chan, Social Enterprise Business Centre

In Hong Kong, there is no legal definition of social enterprise (SE), nor is there a formal registration system or specified legal form for SEs. In the absence of a formal and established regulatory and legal framework, many existing SE practitioners, or those who are interested in setting up one, may easily find themselves in breach of the law due to their lack of legal knowledge. The Social Enterprise Business Centre therefore organized a “Social Enterprise Seminar: The Legal Forms and Corporate Governance of Social Enterprises” on 22 February 2019, where two members of The Law Society of Hong Kong, Mr. Albert So and Ms. Michelle Chow, spoke on the legal forms and corporate governance of SEs.

Legal forms of SEs

Since there are no laws governing SEs and their official registration in Hong Kong, a SE may exist in different legal forms, including a registered society, company, or trust. As some SEs are set up by charitable organizations, some people may confuse them with charities, but there are in fact conceptual differences between the two. A SE is a business enterprise that operates with an intrinsic social objective, whereas a charity may only embody social objectives without having to incorporate any business elements or considerations in its operation. Further, a charity is not allowed to remunerate its directors, while a SE usually distributes a maximum of 35% of its profit to its shareholders.

Prevention of Bribery Ordinance

Mr. So also highlighted the Prevention of Bribery Ordinance (Cap 201) when addressing conflict of interest. The Prevention of Bribery Ordinance prescribes that no agent shall solicit or accept any advantage without the permission of his principal when conducting his principal's affairs or business. “Advantage” in this context includes money, gifts and services, but does not include entertainment. Mr. So therefore reminded participants of the seminar that as a precautionary measure, they should report to their organizations if they feel a potential conflict of interest arise. This would prevent them from committing an offence so long as the relevant agent receives approval or is not involved in the decision-making.

Tax exemption and Business Registration

Section 88 of the Inland Revenue Ordinance (Cap 112) provides that charitable institutions or trusts of a public character may be exempted from tax, and they can seek recognition of such exemption by the Inland Revenue Department. Such organizations are also exempt from the obligation of business registration. In the seminar, a participant shared that, his organization’s funding application was rejected as it could not provide a Business Registration Certificate, even though the organization acquired charitable status. Ms. Chow advised that charitable organizations could provide the certification of tax exemption under Section 88 of the Inland Revenue Ordinance to prove its exemption from tax and business registration.

More than 50 executives from social enterprise and social service sectors attended the seminar.

Staff of SEBC presented souvenirs as a token of thanks to Mr. So (right) and Ms. Chow (middle).

HKCSS has published SE Good Start - "A Practical Guide of Setting up a social enterprise" and "Choosing a Legal Form and Recommended Practices" to provide practical information to aspiring social entrepreneurs. The contents cover the distinction between social enterprise and ordinary enterprise; five stages of setting up a Social Enterprise: Inspire, Incubate, Innovate, Invest, Impact; and information on structuring and choosing a legal form for SEs, as well as recommended practices for SEs, case studies and analyses.

SE Good Start comprises two books. You are welcome to download it from our website: https://socialenterprise.org.hk/en/content/se-setup-guide

Our thanks to Mr. So and Ms. Chow for speaking at the seminar, and the Law Society of Hong Kong for giving professional advice and recommendations on the contents of the seminar.

Corporate Governance and Financial Competitiveness of Social Enterprise

Author: Janie CHAN, Social Enterprise Business Centre

Social Enterprise Business Center, the Department of Accountancy of the City University of Hong Kong, and Davis Polk & Wardwell co-organized a seminar on “Corporate Governance vs Financial Competitiveness: A Scenario of Social Enterprise in Hong Kong” on 22 January. In the seminar, Prof. Phyllis Mo, Dr. Sidney Leung and Mr. Howard Ling, lead researchers of a research on corporate governance of social enterprises (SE), presented the research findings. Ms. Noble Mak, Associate of Davis Polk & Wardwell shared practical advice on drafting the terms of reference of the Committee. Mr. Angus Chan from Comfort Me, spoke on the social enterprise's most recent experience setting up her advisory committee.

SEs with Dual Goals (achieving finance returns in addition to social impact) are more profitable than SEs focusing on only social impact

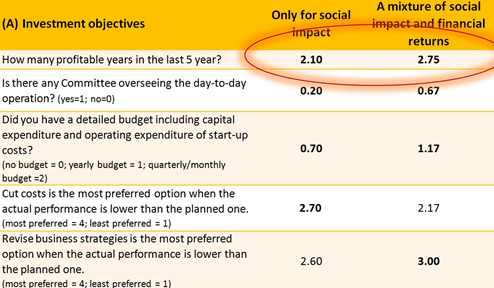

Prof. Mo, Dr. Leung and Mr. Ling conducted a research on the financial competitiveness, sustainability and corporate governance of SEs. The researchers conducted in-depth interviews with 22 local social enterprises with at least 5 years of operation. The sample social enterprises in the study were identified based on the proportional allocation of stratified random sampling.

They found that “SEs that aim at making both social impact and financial returns” had more profitable years in the last 5 years than “SEs that only focus on achieving social impact” (i.e. less concerned with making financial returns). The former had 2.75 profitable years (out of 5); the latter, only 2.10 years.

The research result shows that “SEs that aim at making both social impact and financial returns” had more profitable years in the last 5 years than “SEs that only focus on achieving social impact”.

Overseeing/advisory committee with professional background helps improve an SE's sustainability

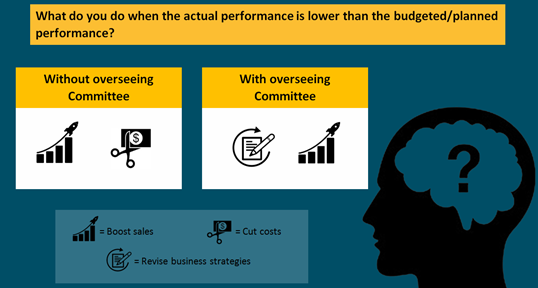

The research team also identified operational differences between SEs with an overseeing/advisory committee and SEs without. For example, the former tends to be more concerned with “sales performance”; and the latter considers “employee issues” as the most important item for discussion in management meetings. When the performance of an SE is lower than the budgeted/planned performance, the former prefers the response option “revising business strategies”; in contrast, the latter tends to get through tough times by “cutting costs”.

The research found that when the performance of an SE is lower than the budgeted/planned performance, SEs with an overseeing/advisory committee tends to respond with “revising their business strategies”; and those without prefers the option of “cutting costs”.

The research also found that having an overseeing/advisory committee is more conducive to an SE's sustainable development. The researchers recommend social enterprises to establish an advisory committee and suggest the inclusion of three types of talents in the committee: “someone with expertise in sales and marketing”, “someone from the accounting and finance profession”, and “someone from an industry related to the SE's business”.

It is advisable to understand relevant legal issues before setting up an Advisory Committee

Ms. Mak, Associate of Davis Polk & Wardwell gave some practical advice on setting up advisory committees. “Before setting up an advisory committee, SEs should identify potential advisory committee members, revise the Articles of Association (and Form NAA1 - Notice of Alteration of Company's Articles), as well as prepare terms of reference for the advisory committee, appointment letter, shareholders’ resolutions and board resolutions. It is also important to carefully consider the committee’s role, composition, members’ level of involvement, reward and compensation, confidentiality, and potential conflicts of interest,” she suggested.

The strategy and considerations of setting up Advisory Committee

The founders of Comfort Me wanted to improve governance by setting up an advisory committee. They also wanted to take advantage of committee members' professional knowledge to expand their business. Mr. Chan believes that it is important that the committee members are from a diverse background. “Having advisors from different professional backgrounds allows SEs to tap into networks other than their own, and acquire new knowledge from outside of their domains. SEs may also invite respected members of their respective fields as advisors, which may help expands their networks and brings more business opportunities, even increases confidence of existing and potential partners and clients.”

Angus emphasized that creating conditions favorable to the effective operation of the committee was as important as setting up a committee. SEs should give appropriate power and responsibilities to the committee, and strive for a balance of opinions within the committee. Committee members should also be open to scrutiny and criticism. Further, SEs may consider offering equity or stock option to committee members to encourage impact investment.

From left: Prof. Phyllis Mo from the Department of Accountancy of the City University of Hong Kong, Mr. Angus Chan, Project Manager of Comfort Me, Mr. Howard Ling, Chief Consultant of Social Enterprise Business Centre, Dr. Sidney Leung from the Department of Accountancy of the City University of Hong Kong, and Ms. Noble Mak, Associate of Davis Polk & Wardwell.

Special thanks to the five guests for speaking at the seminar, and KPMG which provided the venue for free.

More about CityU’s research on corporate governance of social enterprise: https://www.cb.cityu.edu.hk/ac/research/knowledgetransfer/ or scan the QR code below.

Our Centre's corporate partners provide free or discounted business support. Covered areas include: Legal, accounting, banking and insurance, marketing and HR etc. If you are interested in applying, please browse our webpage for more details.

If you are interested in setting up an advisory committee for your SE, please contact Ms. Siu at 2864 2902 / joanne.siu@hkcss.org.hk.